How to Open online saving account in Uco bank

How to Open online saving account in Uco bank

|

| How to Open online saving account in Uco bank |

At present, everything is online, in such a situation, you can open a savings account in a bank sitting at home. To open an online savings account in Uco Bank, you have to follow some simple steps which are given below:

- Eligibility for opening saving account

- Papers are required for opening saving account

- How to open saving account online process

Eligibility for opening saving account

- Age must be at least 18 years to open an account.

- Minimum 10 years for Kids Account.

Papers are required for opening saving account

To open a savings account, firstly you will need some documents:

Photo ID & Address Proof

For this you can use any one of the documents given below -

- Aadhaar Card

- PAN Card

- Passport

- Voter ID Card

- Driving license

- Defense Card etc.

Email ID & Mobile Number

You must have an Active Email ID and an active mobile number.

Because without them you will not be able to open an account.

How to open saving account online process

Follow the steps given below to open UCO Bank Online Saving Account -

1. First go to the official website of UCO Bank - uco bank online account

2. Then you will get a format like this, where you can open a personal account -

|

| Uco bank online saving account |

3. Here you have to tick Yes option in the questions asked -

Do You Have Email Id ✓

Do You Have PAN No ✓

4. After filling the Date of Birth, click on Next.

5. Now you will have a UK bank savings account form.

6. Which you have to fill step by step with many types of information.

7. So by first selecting Saving Account in Account Type -

|

| How to Open online saving account in Uco bank |

State

City

Branch

Etc. have to be selected.

8. In the next step you have to enter Applicant Details -

|

| uco bank Applicant Details |

UCO Bank 1st Applicant Details

In which your name, parents name and similar personal information. Have to give.

9. Then you have to give information related to your work and income -

UCO Bank Account Opening Facilities

10. Now enter Residence Tax related information -

UCO Bank Applicant Residence

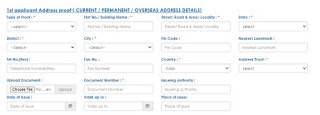

11. After that you have to enter your address proof details -

UCO Bank Applicant Address Proof

12. And if your current and Permanent Address is the same, then in the next Address Proof, you tick (address) the address same as Current.

13. Finally, after giving you the information of Photo ID Proof, upload the documents -

Applicant Photo ID Proof

14. After that, fill the Captcha Code, click on Save and enter the OTP received on the mobile and verify it -

|

| How to Open online saving account in Uco bank |

UCO Bank OTP Verification

15. Finally you will get reference numbers.

Note: Within the next 7 days, you should print out the form, visit Yukon Bank with the document.

Some important Links you must read

- Uco Bank Customer care number | 24*7 Toll free number

- How to register uco bank net banking online and offline | Customer care-1800 274 0123

- Uco Bank All india Branches Swift code | Email id | contact Number

- How to link Adhaar with Uco bank account

Tags: uco bank online | uco online | uco bank current account opening | uco bank customer care

| uco bank savings account minimum balance | uco bank bc online application | uco bank passbook online | how to transfer uco bank account to another branch online

ReplyDeleteThank you for sharing this valuable and important info with us. To know more on Bank Account Online Open

Thank you for sharing such a piece of great information. To get best offers and deals. Click here to know more open online bank account

ReplyDelete